“The TDC dollars can be used for transit”, said Pinellas County Commissioner Janet Long in a PSTA executive committee meeting on October 12th. Long was referring to the Tourist Development Council (TDC) and the tourist development tax dollars they manage. However, the Florida statute governing the uses of such funds does not list “transit” as an authorized use.

Fellow PSTA executive committee member Darden Rice, a St. Pete city council member, can be heard agreeing when Long made her remark. None of the other committee members spoke up to correct Long. Those members were Clearwater vice-mayor Bill Jonson, Dunedin mayor Julie Bujalski, Belleair Bluffs commissioner Joe Barkley and Pinellas Park councilwoman Patricia Johnson.

Janet C. Long

Long qualified her comment, saying that such use of the bed tax funds would be authorized “if you can tie a transit solution to tourism”, emphasizing the word “if” when she spoke.

However, such conditional authorization also does not exist in Florida Statutes §125.0104, which is the state law authorizing the levying and spending of the tourist development tax dollars. The tax is popularly known as the “bed tax” because it is a tax imposed hotel rooms and vacation rentals, or “transient accommodations” as they are called in the statute.

“I could make a very solid argument for using for that sixth penny to be totally poured into transportation solutions”, Long said, using the word “transit” instead of “transportation” as she continued to speak. However, the statute also does not authorize the use of bed tax funds for “transportation” except in cases of so-called “fam trips”. The purpose of such trips is to familiarize “travel writers, tour brokers, or other persons connected with the tourist industry” with Pinellas County and the Tampa Bay area.

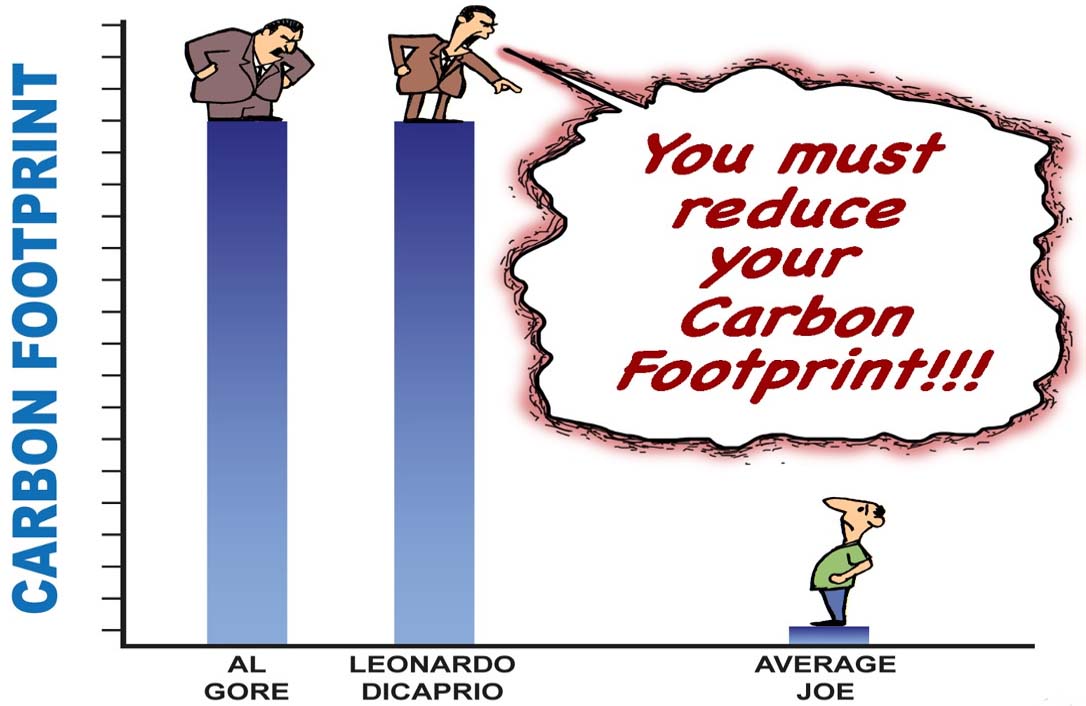

Elected officials and transit promoters often the words “transit” and “transportation” interchangeably, even though transit is a very small subset of transportation. According to the US Department of Transportation, transit made up approximately 1.2% of all passenger miles traveled in 2014, down from 1.4% in 1980.

No Tax For Tracks (Pinellas)

“She’s mining for dollars again”, said No Tax For Tracks spokeswoman Barb Haselden, who led the 2014 effort to defeat Greenlight Pinellas. “PSTA just raised our property taxes last month, and that hasn’t even taken effect yet. There’s never enough funds for money losing operations, no matter how much money PSTA has, when they just continue to add more expenses and continue to gamble on high risk projects.”

“What’s the point of having a dedicated funding source for PSTA or any agency if they just keep looking for more money from other funds?” Haselden continued.

Last month, the PSTA board of directors voted to increase the millage rate to 0.75, the highest allowed under its authorizing statute. PSTA increased it’s operating budget by 11% in the current fiscal year that began on October 1. PSTA’s total spending is increasing an eye-popping 28.3% in the current fiscal year.

“PSTA needs to cut costs and operate within their budget”, Haselden said, speaking from the Boston area during a family trip. “The bed tax dollars are not their money, and Janet Long is trying find a language loophole to fund yet another transit boondoggle in the face of rapidly declining PSTA ridership. Already in 2014, we said: there is no need, and no demand, for more transit.”

Despite being given three days, neither Janet Long nor her assistant Doyle Walsh responded to our questions and our request for comment by the time of publication. One of the things we asked was “do you stand by your claim?”

Despite being given three days, neither Janet Long nor her assistant Doyle Walsh responded to our questions and our request for comment by the time of publication. One of the things we asked was “do you stand by your claim?”

Should we receive a response from Long or her office, we will update this article accordingly.

Long’s comments may be just another trial balloon in the battle over what to do with the record volume of bed tax dollars. 17% of those funds were already being put aside and not spent for several years, and an even higher percentage has been banked since the bonds for Tropicana Field were paid off last year. The Tampa Bay Rays baseball team is seeking taxpayer funding of a new stadium.

The statute expressly authorizes bed tax funds to be spent on e.g. “beach park facilities” and “shoreline protection, enhancement and cleanup”, but the county commission has elected to not do so except for beach renourishment.

The county has no plans to ask voters what they think is the best use of all this money, which reached approximately $50 million dollars in the fiscal year that ended on September 30th. This amount has doubled in the last 9 years due to an increased bed tax rate and increasing tourism.

As always, the Guardian reports and the readers decide. Please like our Facebook page to find out when we publish new stories.