Despite three employees receiving written reprimands for “negligence or carelessness in carrying out job duties” resulting in a $49,000 loss, a phishing fraud committed against the City of Largo was never publicly disclosed. It was also not mentioned in the city’s annual financial report. The fact that the fraud was successful raises the question whether insufficient financial controls were in place.

The $49,000 loss was charged to the city’s so-called Risk Fund, an internal service fund. It was handled in this way in violation of city policy and nationally accepted accounting standards that the city’s finance director says they adhere to.

The city itself says that the Risk Fund is to be used to pay “estimated claims payable and City Commission and Police Chief annuity payable related to retirement payments not covered by pension plans.” The $49,000 loss does not fit this description, which suggests an effort to sweep the large and embarrassing loss under the rug.

The Guardian made a public records request to the city for “any Governmental Accounting Standards Board (GASB) so called ‘guidance statements’ that the city adheres to in accounting for losses due to fraud “ involving this kind of fraud loss.

“We adhere to all GASB standards,” Rebecca Spuhler, Largo’s Finance Director responded via email. “Is this a public record request or a question?”

Spuhler’s blanket claim of adhering to “all GASB standards” is difficult to reconcile with GASB statement 34, ¶68. It states that “internal service funds may be used to report any activity that provides goods or services to other funds, departments, or agencies of the primary government.” However, a loss due to fraud is neither “goods” nor “services” that are provided to city departments or agencies.

GASB 34, ¶68 also states that “internal service funds should be used only if the reporting government is the predominant participant in the activity. Otherwise, the activity should be reported as an enterprise fund” [bold facing added]. Losses due to fraud clearly do not fit within that standard.

A fraud loss of this nature would ordinarily be reported in the General Fund got transparency, or disclosed as a special item or loss contingency — not embedded within an internal service fund.

“The Purchasing policy dictates that purchases above $25,000 need to go to the Commission for approval,” Spuhler claimed. “This was not an elective purchase” [boldfacing added]. Spuhler cited and provided the City’s Risk Management Policy, Risk Fund Claim Procedures and Purchasing Policy in the City’s Administrative Policies and Procedures Manual as authority for her position.

However, the qualifying word “elective” Spuhler used does not appear in any of the policies cited by her. In fact, the word “elective” does not appear anywhere in the city’s 248-page manual.

In other words, the policies Finance Director Spuhler cited makes no difference between an “elective” and any other purchase, leaving the appearance that city staff simply “tortures the text” in procedures and policies until it means what they want it to mean.

Spuhler was employed by the city when the fraud took place in July of 2019, but Kimball Adams was the finance director at the time. Adams held that position for 35 years before retiring in 2022. Upon Kimball’s retirement, his successor Spuhler told him that he’s “not off the hook.”

“Don’t worry; I’ll call you,” Spuhler admiringly told Adams after he told her to reach out to him if she needed his help.

As far as what (or who) “dictates” the city’s accounting decisions, including the obscured accounting treatment of the “fraudulent wire loss” (Spuhler’s term for it), the dictator may turn out to have been Adams. More on that in a future article.

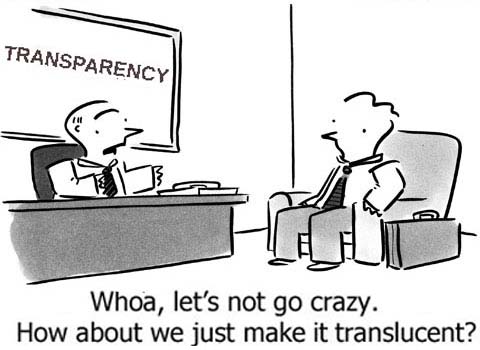

The city’s allegedly Comprehensive Annual Financial Report (CAFR) for the year in question (FY2019) didn’t promise transparency — and the public didn’t receive it, either. Neither the $49,000 loss nor the potential material weakness in financial control that it exposed were disclosed.

The City generally and genuinely appears confused about what the word “transparency” means, claiming for example that a third-party platform for making public records requests somehow improves transparency. It doesn’t, but forthrightly publicly disclosing to the taxpayers losses of $49,000 due to fraud would be such transparency. Especially since three city employees received written reprimands over the loss of these public funds.

So how was the fraud carried out? We’ll let the City of Largo provide the narrative it gave in a written reprimand dated August 22, 2019, exactly one month after the loss of public funds occurred. This written reprimand of Jodie White, a Housing Specialist with the City of Largo, says that this is what happened:

On July 22, 2019, a wire transfer of $49,000 was authorized for payment to Fidelity National Title Services for downpayment assistance for a housing case. As a result of this authorization, a wire fraud occurred and the funds were sent to an incorrect bank as a result of an email scam. During the wire transfer process, you and another housing staff member received fraudulent emails pertaining to the pending wire transfer and used the fraudulent instructions to direct the wire transfer to the incorrect bank.

A review of the emails shows that the original, valid email from Fidelity Title with the wire instructions was sent as a “smartmail secure mail” on July 19. The email included a statement, “Please be aware, on-line banking fraud is on the rise. If you receive an email THAT APPEARS TO BE GENERATED from your escrow officer or assistant at any point CHANGING THE WIRE INSTRUCTIONS, PLEASE CALL YOUR ESCROW OFFICER IMMEDIATELY!”

On July 22, a fraudulent email was received that appeared to be from Fidelity Title and said that the wire instructions would be changed. A subsequent, fraudulent email contained wire instructions that directed the funds to a different bank. The wire authorization was prepared and signed by the Housing Division Manager. The authorization was sent to the Finance Department, which wired the funds to the incorrect bank. The wire fraud was subsequently discovered when the title company did not receive the funds. However, the funds could not be recovered.

Notably, the fraudulent email came from the email address “repllyto1@gmail.com,” which should have raised red flags and set off alarm bells, even among children. Yet in Largo City Hall, it didn’t.

All three written reprimands stated that “this disciplinary action is a Written Reprimand for a violation of Code of Conduct Violation #20 – Negligence or carelessness in carrying out job duties.”

Notably, then Community Development Director Matt Anderson received a written reprimand, yet also signed the other two written reprimands as “immediate supervisor” to Jodie White and Housing Grants Specialist Arrow Woodard. It appears to be a case of the reprimanded leading the reprimanded.

At least one more article about the actions of the City of Concealment City of Largo in this matter will follow.

As always….the Guardian reports and the readers decide. Please like our Facebook page to find out when we publish new stories.