Lightning owner Jeff Vinik has violated Florida law every year since he purchased the team by not registering the out-of-state corporation that owns the team with the State of Florida. In doing so, Vinik has avoided paying annual fees and also not had to meet disclosure requirements.

Vinik is the Chairman and sole person controlling the corporation.

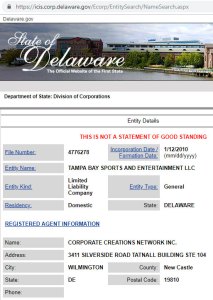

The Tampa Bay Lightning is owned by a Delaware corporation called Tampa Bay Sport and Entertainment, LLC (TBSE). When the NHL announced the sale of the Tampa Bay Lightning on February 5th, 2010, TBSE was mentioned by name as the new owner. TBSE is thus a Delaware corporation that transacts business in Florida.

Incorporating in Delaware instead of Florida makes TBSE a “foreign corporation” under Florida law. Florida Statute 607.1501 states that “a foreign corporation may not transact business in this state until it obtains a certificate of authority from the Department of State.”

Incorporating in Delaware instead of Florida makes TBSE a “foreign corporation” under Florida law. Florida Statute 607.1501 states that “a foreign corporation may not transact business in this state until it obtains a certificate of authority from the Department of State.”

However, since purchasing the Lightning, TBSE never obtained the required certificate from the state. The Guardian confirmed this through a phone call with the Florida Division of Corporation.

Other foreign corporation large and small, like General Electric, ExxonMobil, Microsoft, Apple, McDonald’s, and even Whataburger, all have registered as foreign corporations. But not Vinik’s TBSE.

Florida Statute 607.1502 specifies the penalties and consequences for such failure to register as a foreign corporation. The financial costs of this failure to register may be as high as $15,000, but that’s pocket change to TBSE and Vinik. Instead, an important question is what information was withheld as a result.

Had TBSE registered as a foreign corporation, it would have had to fill out this form disclosing all its officers and all directors. It would also have had to disclose its street address, something which Delaware does not require.

A street address can provide important information, as Jim Bleyer showed yesterday in Sunshine State News. That bombshell article revealed an important but previously undisclosed TBSE business activity.

Had TBSE complied and registered as a foreign corporation, it also would had to update the state about who its current officers and directors by filing an annual report. By not filing, it has avoided doing so for nine years.

Apple filed such an annual report last month. Microsoft did so this month, and in its filing, Microsoft disclosed over 200 officers and directors.

Even less well-known companies with a tiny Florida footprint complied as Vinik did not. For example, the direct-to-consumer makeup company Glossier registered as a foreign corporation with Florida on December 7th last year. Like TBSE, Glossier is also a Delaware corporation. Their only business in Florida that requires registration is a pop-up store in Miami. That store is only open from March 26th to May 5th this year.

59-year old Vinik has a B.Sc. in Civil Engineering from Duke and a MBA from Harvard Business School. Emily Weiss, the 34-year old founder and CEO of Glossier, has B.A. in Studio Art from NYU and no MBA. However, Vinik and Weiss do have one thing in common: they are both born on March 22nd.

In just 4.5 years, Weiss has built Glossier from zero into a company valued by investors at $1.2 billion. In twice that amount of time, Vinik has built a strong regular season hockey team that he used as leverage to obtain a $150 million reduction in his tax bill.

In contrast, Glossier received no public handouts or favoritism from elected officials.

Vinik even managed to get the Tampa Port Authority to provide $1.7 million when one his companies bought Channelside Plaza, now renamed Sparkman Wharf.

“Vinik will be the Chairman and sole person controlling TBSE,” said the NHL in 2010. If Vinik is still the “sole person controlling,” he is apparently and ultimately responsible for the failure of TBSE to file as a foreign corporation, as well for the failure to annually disclose its officers and directors.

As a result of nine years of non-disclosure, the public is left in the dark about who benefits as Vinik seeks larger and larger tax subsidies from local government. Are elected official benefiting financially? Who has benefited in the past? The public has no way of knowing because it hasn’t been provided the information that by law it is entitled to.

As the lines blur between business and government, between the Tampa Bay Times and Vinik, the ancient question cui bono comes to mind. Who benefits from these blurred lines and from Vinik’s flouting of clear disclosure requirements? One group that we can be sure does not benefit is the taxpayers.

Please like our Facebook page to find out when TampaBayGuardian.Com publish articles.